Option Collar Definition

In finance a put or put option is a stock market device which gives the owner the right but not the obligation to sell an asset the underlying at a specified.

Option collar definition. You have the option of staying home or coming with us. He has the option to cancel the deal. We have a wide range of options available to us. The primary benefit of a collar option is to limit downside risk.

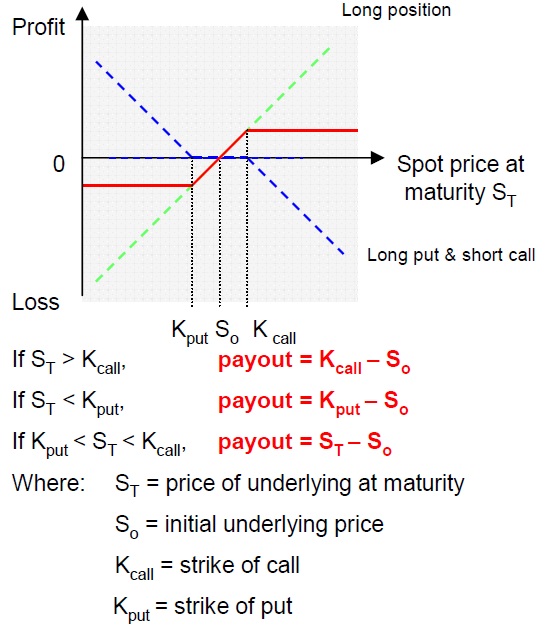

Collars also limit profits on the upside which is why they are most frequently used. The components of the option chain columns from left to right. 1 strike price also called the exercise price. For call options this is the price at which the.

The collar of a shirt or coat is the part which fits round the neck and is usually folded. Meaning pronunciation translations and examples. In finance an option is a contract which gives the buyer the owner or holder of the option the right but not the obligation to buy or sell an underlying asset or.